If you’re using Shopify, you know how crucial it is to have a smooth Shopify Payment Methods process. Offering various payment options can boost sales significantly, as shown by a Weave study reporting a 30% higher conversion rate for merchants who provide multiple options.

By understanding Shopify payment methods and choosing the right options for your store, you can create a smooth and secure shopping experience for your customers, ultimately boosting your sales and customer satisfaction.

In this article, we’ll highlight the top 8 Shopify payment methods for 2024. Let’s explore!

What are Shopify Payment Methods?

Shopify payment methods are essentially how customers can pay for their purchases in your store. These methods integrate seamlessly with your Shopify store through a payment gateway, streamlining the checkout process for you and your customers.

Shopify offers a variety of payment methods to cater to your specific needs and your customers’ preferences. Here are some popular options to consider:

- Shopify Payments: This is Shopify’s own integrated payment solution. It offers ease of use, competitive transaction fees, and eliminates the need for a separate merchant account.

- Third-Party Payment Gateways: Popular options include Paypal, Stripe, Amazon Pay, and Apple Pay. These providers offer additional features like fraud prevention tools and international payment processing.

- Alternative Payment Methods: Depending on your target market, you might consider offering alternative methods like digital wallets or buy-now-pay-later options.

How Payment Processing Works?

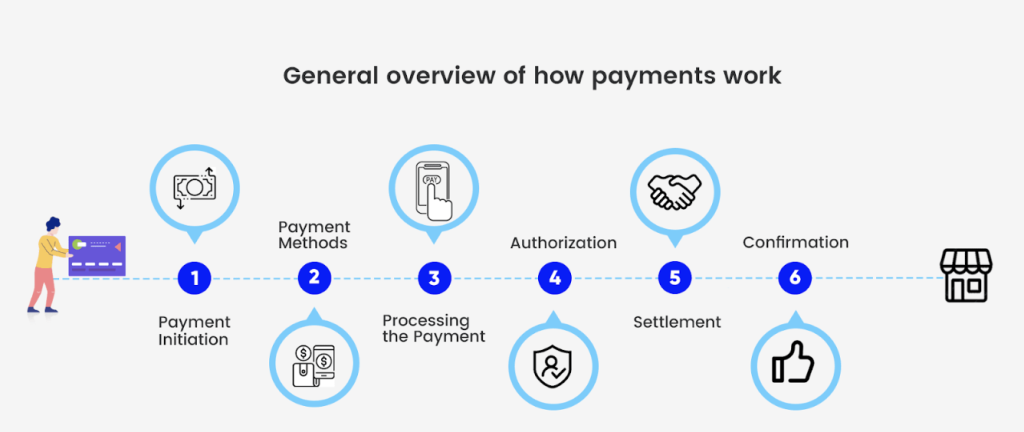

This is the payment process!

- Customer Checkout: When a customer reaches the checkout stage and selects their preferred payment method, the payment process begins.

- Payment Gateway Integration: The chosen payment method triggers communication with the integrated payment gateway. Think of the payment gateway as a secure bridge between your store and your customer’s bank.

- Customer Information Transfer: The payment gateway securely transmits the customer’s payment information (e.g., credit card details) to the issuing bank for authorization.

- Authorization and Verification: The bank verifies the customer’s information and available funds to approve or decline the transaction. Additional security measures like Address Verification System (AVS) checks might be employed to prevent fraud.

- Transaction Processing: If approved, the bank sends authorization back to the payment gateway, completing the transaction and transferring funds to your account.

- Order Confirmation: Your customer receives a confirmation of their successful purchase, and you’re notified of the completed order.

Criteria For Good Shopify Payment Method?

Here’s a list of critical features to consider when choosing Shopify payment methods:

- Security: This is the top priority. Look for features like encryption, PCI compliance, and fraud prevention tools to ensure your customers’ financial information is safeguarded. Strong security builds customer trust and protects your business from fraudulent transactions.

- Fees: Transaction fees can impact your profits. Compare fees associated with each method. Shopify Payments offers competitive rates, while third-party providers might have varying fee structures. Look out for additional monthly fees and hidden charges like chargeback or currency conversion fees to avoid surprises.

- Acceptability: The broader range of payment methods you offer, the more customers you can reach. Consider offering credit card processing for major brands like Visa, Mastercard, and American Express. Debit card processing is also vital for many customers.

- API Integration: If you plan to connect your Shopify store with other business applications, ensure your payment method offers an open API and precise documentation. This allows developers to integrate the payment functionality seamlessly with your other tools, creating a more efficient and automated business system.

- Convenience: A smooth checkout experience is essential. Choose payment methods that integrate easily with your Shopify store and offer a fast, secure checkout process with minimal steps.

- Recurring Billing: For subscription-based businesses, consider methods that support automatic recurring payments and offer customer management tools. This streamlines your subscription process, reduces manual work, and helps prevent failed payments due to outdated payment information.

- International Support: If you want to sell globally, choose payment methods that support multiple currencies and international payment networks. This allows you to process transactions from customers worldwide and expand your reach.

Analyze Top 8 Best Shopify Payment Methods

These are the top 8 with detailed analyses about features, pros and cons, and suitable users!

1. Shopify Payments

URL: Shopify Payments

What are the key features of Shopify Payments?

- Competitive fees: Lowers your running costs by eliminating the 2.2% transaction fee typically charged by Shopify for third-party payment methods. Fees can be further reduced with higher Shopify subscription plans.

- Fast payouts: Receive your funds within 24 hours, ensuring quicker access to your revenue.

- Integrated with Shopify: Seamless integration eliminates the need for a separate payment gateway setup.

- Easy to use: Simple interface for both store owners and customers.

- No setup fees: Only pay your regular Shopify subscription fee and standard card processing charges.

How about pros and cons?

| Pros | Cons |

| – Shopify Payments integrates seamlessly with your Shopify store, offering a smooth checkout experience for your customers. – Enjoy competitive transaction fees and avoid additional charges typically associated with third-party payment gateways. – This can be a significant cost saver, especially for businesses with high transaction volume. – Receive your funds within 24 hours, ensuring quicker access to your earnings. – Shopify Payments provides reporting and analytics tools to gain valuable insights into your sales performance. – Manage payments and orders from a single platform, streamlining your back-office operations. | – Shopify Payments might not be available in all countries, so check eligibility before setting your heart on it. – Certain business types in specific industries might be restricted from using Shopify Payments. – You might require additional payment gateways to handle international transactions seamlessly. |

What this method is ideal for?

Shopify Payments’ user-friendly interface and competitive fees make it an excellent choice for businesses starting their online journey. So, it is pretty suitable for Small Businesses and Startups!

Plus, Businesses Seeking a Streamlined Solution are also appropriate! If you value a centralized platform for managing payments and orders, Shopify Payments offers a convenient all-in-one solution.

2. Stripe

URL: Stripe

What are the key features of Stripe Payments?

- Wide customer acceptance

- Multi-platform integration

- Competitive fees (be aware of variations)

- API-driven for customization

- Strong security measures

How about pros and cons?

| Pros | Cons |

| – Stripe transcends borders. It supports a wide range of currencies, making it perfect for businesses with international ambitions. – Stripe goes beyond basic transactions. It offers features like one-click checkout, subscription billing, and recurring payments, streamlining the buying experience for your customers and potentially boosting conversions. – Stripe’s robust API and extensive documentation empower developers to customize and integrate the platform with your Shopify store seamlessly. – Security is paramount. Stripe prioritizes secure transactions with fraud protection measures and secure payment processing. – Stripe offers relatively low transaction fees, especially for international transactions (be aware of potential variations depending on location and currency). | – Setting up and customizing Stripe effectively might require some technical expertise. This can be a hurdle for businesses without developers on hand. – Transaction fees can fluctuate based on location and currency, so careful evaluation is necessary to understand potential costs. – Free plans might come with limited customer support options, potentially causing delays in resolving issues. |

What this method is ideal for?

Stripe’s versatility makes it a strong choice for businesses offering various payment options to their customers. So, E-commerce Businesses Accepting Multiple Payment Methods are suitable!

Plus, it is Businesses with Developers! If you have in-house developers or are comfortable with technical aspects, Stripe’s customization capabilities can be a significant advantage.

3. PayPal

URL: PayPal

What are the key features of PayPal Payments?

- Wide customer acceptance

- Buyer protection

- International payment support

- Easy Shopify integration

- Multi-currency support

- Predictable flat-rate pricing (be aware of fees)

How about pros and cons?

| Pros | Cons |

| – A globally recognized brand trusted by millions, PayPal attracts customers who might not have traditional credit cards. – PayPal’s buyer protection policies give customers peace of mind, potentially increasing conversion rates at checkout. – Seamlessly accept payments from customers worldwide, expanding your reach to a global audience. – Simple integration with your Shopify store ensures a smooth setup process. – Handle transactions in a large number of currencies, catering to international customers. – Transparent flat-rate fee structure makes cost budgeting easier. | – Transaction fees, especially for international transactions, can eat into your profits. – The possibility of PayPal placing holds on your account or mediating customer disputes can be inconvenient. – While generally secure, PayPal might not be the most cutting-edge security solution compared to some other payment processors. – Obtaining customer support from PayPal might be challenging. |

What this method is ideal for?

Businesses Targeting International Customers should use PayPal! Why? The ease of international transactions makes PayPal a strong choice for businesses with a global audience.

Plus, Established Businesses already using PayPal and leveraging its brand recognition, integration with Shopify can streamline operations.

4. Opayo

URL: Opayo

What are the key features of Opayo Payments?

- Fort Knox Security

- Recurring Revenue Ready

- Multi-Channel Payments

- PayPal Integration

- Streamlined Operations

- Receive your funds quickly after transactions are processed

How about pros and cons?

| Pros | Cons |

| – Ideal for businesses prioritizing secure transactions. – Simplifies management of subscription-based services. – Caters to diverse customer preferences.Improves cash flow by accelerating access to funds. | – Be prepared for a potentially lengthy account verification process (up to 5 weeks) before you can start processing transactions. – Opayo charges monthly fees (starting at £19) instead of per-transaction fees, which might be less cost-effective for low-volume businesses. – Opayo’s services might not be available in all regions, so check for eligibility before choosing it. – Certain features and integrations might incur additional charges. |

What this method is ideal for?

Opayo’s regional focus makes it a strong contender for businesses operating in the UK. So, the most suitable is UK-Based Shopify Stores!

Next is Subscription-Based Businesses! Because the seamless handling of recurring payments streamlines subscription management.

5. Square

URL: Square

What are the key features of Square Payments?

- Unified Point-of-Sale (POS) System: Manage in-person and online payments seamlessly with Square’s integrated POS system.

- Mobile Payment Support: Accept payments on the go using Square’s mobile processing options, increasing flexibility for your business.

- User-Friendly Dashboard: Gain insights and manage transactions, cash flow, and inventory effortlessly through a user-friendly interface.

- Security and Compliance: PCI compliance and end-to-end encryption ensure secure transactions, protecting your business and customers’ information.

- Fast Fund Transfers: Receive your funds quickly within 1-2 business days, improving your cash flow.

- App Marketplace: Extend Square’s functionalities with various integrations and tools available through their app marketplace.

How about pros and cons?

| Pros | Cons |

| – Square offers a one-stop shop for managing in-person, online, and mobile payments, streamlining operations for small businesses. – Easy to UseSquare’s flat-rate pricing structure is relatively affordable for businesses with lower transaction volumes. | – Square’s functionalities might not be robust enough to handle the demands of high-volume businesses. – Certain features and integrations within the app marketplace might incur extra charges. – There have been reports of occasional stability issues with Square’s platform. |

What this method is ideal for?

Square’s comprehensive yet user-friendly features make it a strong contender for small businesses and startups getting started with online and in-person payment processing.

Moreover is Businesses Accepting Mobile Payments and Businesses on a Budget!

6. Klarna

URL: Klarna

What are the key features of Klarna Payments?

- Buy Now, Pay Later (BNPL): Klarna provides customers the flexibility to split their purchase into installments, potentially increasing cart size and conversion rates.

- Interest-Free Payments: Klarna’s BNPL option is typically interest-free, making it an attractive payment method for budget-conscious customers.

- Fraud Prevention: Advanced security features protect your business from fraudulent transactions.

- Buyer Protection: Klarna offers buyer protection programs, potentially adding trust and security for your customers.

How about pros and cons?

| Pros | Cons |

| – The BNPL option provides flexibility and convenience, potentially leading to higher customer satisfaction and sales. – Customers are less likely to abandon carts if they can pay later in installments. – Klarna’s transparent fee structure with a base fee and per-transaction fee makes cost estimation easier. – Easy Shopify Integration | – Klarna’s services might not be available in all regions, so check for eligibility before choosing it. – There have been reports of limited customer service options, which might be a drawback in case of issues. |

What this method is ideal for?

Klarna’s BNPL model works well for products typically purchased in installments, such as clothing, furniture, or electronics. So, Businesses with Suitable Products is propriate!

Next is Businesses Targeting Increased Sales! The potential for higher conversion rates and cart size can benefit businesses aiming to boost sales.

7. Worldpay

URL: Worldpay

What are the key features of Worldpay Payments?

- Supports over 120 currencies, making it ideal for businesses selling internationally.

- Advanced Fraud Protection

- Seamlessly handle recurring payments (subscriptions, memberships) for businesses with subscription-based models.

- Multi-Channel Payments

- Customizable Checkout

How about pros and cons?

| Pros | Cons |

| – Worldpay’s extensive currency support caters perfectly to businesses with a global customer base. – Advanced fraud prevention measures provide peace of mind when accepting international payments. – Streamlines management of subscription-based services.Offers flexibility for customers to pay through their preferred channels. – Enhances brand experience during the checkout process. | – Worldpay offers two monthly plans (Standard & Advanced) with potentially ambiguous pricing details requiring careful evaluation. – Worldpay’s services might not be available in all regions, so check for eligibility before choosing it. – Certain features and integrations might incur extra charges. |

What this method is ideal for?

Large, Global Enterprises because Worldpay’s global reach and multi-currency support are well-suited for businesses with a significant international customer base.

Businesses with Recurring Billing and Businesses Accepting Multiple Payment Methods are also suitable!

8. Verifone

URL: Verifone

What are the key features of Verifone Payments?

- Verifone offers a complete POS system including hardware (card readers) and software, ideal for in-person transactions.

- EMV Support (Europay, Mastercard, Visa)

- Integrates with mobile wallets like Apple Pay and Google Pay for contactless payments.

- Advanced Security Features

- Tax Calculation

- Valuable reporting and analytics tools

- Flexible Pricing

How about pros and cons?

| Pros | Cons |

| – Verifone provides a one-stop shop for hardware and software needs, simplifying payment processing setup. – Robust security features like fraud detection and prevention minimize transaction risks. – It supports the EMV (Europay, Mastercard, Visa) standard, a global security measure that protects against fraudulent card transactions. | – Transaction fees can fluctuate based on volume and payment method, requiring careful evaluation. – Verifone’s services might not be available in all regions, so check for eligibility before choosing it. – Specific features and integrations might incur extra charges. |

What this method is ideal for?

Businesses with Physical Stores, Tech-Savvy Businesses, and Businesses Accepting Diverse Payment Methods!

Conclusion

Our overview of the finest Shopify payment methods makes it clear that each option offers distinct features, advantages, and limitations. This array of choices enables you to select the best fit your business requirements.

When deciding, consider factors such as transaction fees, integration simplicity, global reach, and customer preferences. Armed with this knowledge, you’re ready to navigate the world of Shopify selling confidently!